Three Corporate Governance Models:

EMERGENCE OF CORPORATE GOVERNANCE MODELS

Corporate Governance models refers to the way companies are financed and structured in an economy in terms of entrepreneurial and functional decision-making. Over the past forty or so years, main three corporate governance models have emerged in the world. Most countries in the world have one or other of these models, or their variation, in use.

Anglo-American Model (AAM).

Japanese Model (JM).

German Model (GM).

The Anglo-American Model:

Corporate Governance Models no one:

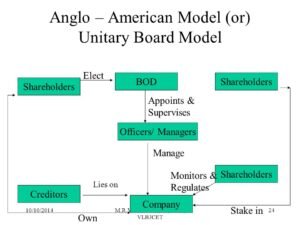

This model is based on free-economy theory and operates essentially on the premise that the free inter-play of market forces sets the price for capital as well as decides who gets to run a company. Companies in this model operate to maximize the wealth of its shareholders who decide who to assign the responsibility of running the company.

The directors of the company do not necessarily own a big chunk of company’s shares their election is dependent on their efficiency and ability to convince the investor of their usefulness. The prime measure of their efficiency is the rate of return earned on the von The AAM works on a triangular principal-watchdog-agent relationship, comprising of shareholders (who hold the voting power), the non-executive directors (who are elected by shareholders to look after their interest and are therefore in watchdog role) and the managers (including the executive directors) who are hired by the Board to carry out day to day operations of the company.

The Japanese Model:

Corporate Governance Models no Two:

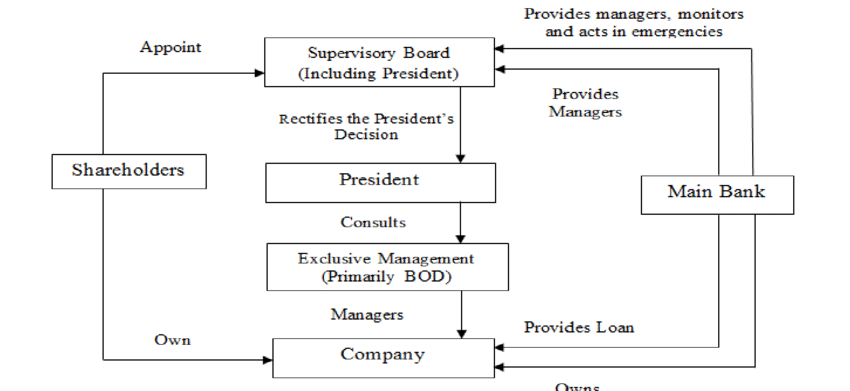

The Japanese companies most follow the keiretsu system, which by definition means a group of associated or related companies having inter-locking directorates and shareholding.

Typically a group has a number of companies, some operating in the same industry, others in the different industries. Quite often the nature of the business of companies in a keiretsu or a group is related.

For example, in an vertical keiretsu all the companies in the group may be engaged in activities related to the same group of products, but at different levels. On the other hand, in a horizontal keiretsu, companies and entities in the group may not be engaged in similar business but in diverse set of activities.

The German Model:

Corporate Governance Models no Three:

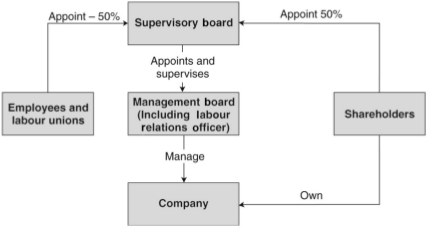

Quite like the Japanese model, institutional investors, including both private and public their corporate governance model. The boards of German companies have a sector banks, play a very important and powerful role in the German companies and significant number of nominees from financial institutions who ostensibly represent not only their parent bodies but also look after the interest of all stakeholders.

Perhaps the directors. In Germany, companies are required to have a two tier board by law. The lower tier, called Management Board comprises entirely of executive directors.

The upper tier is non-executive supervisory board having compulsory representation from institutional investors and employees. No one can serve at both tiers of the board. However, the supervisory board can summon members of lower tier for clarification at its meetings.

The size of the supervisory segment of the board is set by law (or regulators, according to pre-defined parameters) and cannot be changed by shareholders or other stakeholders.

The law also assigns a pattern of casting vote rights to supervisory board regardless of the company’s ownership structure. In this way, the supervisory board is in a better position to exert its influence and get its policies implemented by the lower executive tier.

This stringent hold of institutional investors over corporate boards allows the companies to have a much higher debt to equity levels. The proportion of individual ownership of shares in German companies is relatively lower than in USA.

https://fantesticfinance.com/6-easy-financial…ios-and-formulas/